Manageria

» July 2025

» Jan 2025

» July 2024

» Jan 2024

» July 2023

» Jan 2023

» Oct 2022

» July 2022

» Apr 2022

» Jan 2022

» Oct 2021

» July 2021

» Apr 2021

» Jan 2021

» Oct 2020

Add To What You Know

Prepared by: optimanage.com

Financial Management - Some Pointers: (1)

Budgets: They are statements that formalize the goals of an organization in financial terms.Budgets are a management tool for:

Planning

Organizing

Controlling

Financial performance standards

Framework for comparing businesses

Organizing

Controlling

Financial performance standards

Framework for comparing businesses

Top-Down Budgeting; prepared by Top Management

Bottom-Up Budgeting; prepared by lower-level managers

Bottom-Up Budgeting; prepared by lower-level managers

Operating Budgets

Cost center budget approach

Revenue center approach

Profit center Approach

Revenue center approach

Profit center Approach

Cash and capital expenditure budgets

Material budgets

Balance sheet budgets

Material budgets

Balance sheet budgets

Audits: They are a way to formally evaluate an organization’s financial situation. They are also a tool of control used by management.

Audits are carried out to:

Determine that the financial statements are correct and that they have been developed according to the accepted accounting and auditing standards.

Determine that the actual financial performance of the organization meets the performance standards present in the budget projections.

Determine that the actual financial performance of the organization meets the performance standards present in the budget projections.

Internal Audits

Internal audits are carried out to supply management with timely data and information to allow for effective decision making. These audits are performed by internal auditors.

External audits are frequently presented to entities outside the organization as proof of financial health of the organization. Such official audits are performed by external accounting professionals (Certified Public Accountants/CPA). The CPA would certify the validity of the audit.

Planning - Some managerial Pointers: (2)

Planning strategy and setting goals have five major components:The Benefits of strategy (Peter Drucker):

References:

(1) Patrick J. Montana and Bruce H. Charnov, “Management”, Business Review Books, Third Edition, Baron’s (2000), p287-295.

(2) Patrick J. Montana and Bruce H. Charnov, “Management”, Business Review Books, Third Edition, Baron’s (2000), p136-138.

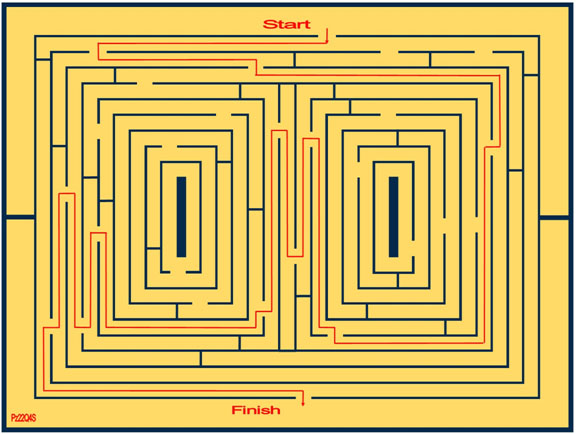

>> Solution to the Maze from the previous page: