Manageria

» July 2025

» Jan 2025

» July 2024

» Jan 2024

» July 2023

» Jan 2023

» Oct 2022

» July 2022

» Apr 2022

» Jan 2022

» Oct 2021

» July 2021

» Apr 2021

» Jan 2021

» Oct 2020

Add To What You Know

Prepared by: "Optimanage.com"

Determining the Break-Even Quantity for a Production Operation (1)

The Break-Even Quantity (BEQ) in a production operation enterprise is that quantity needed to be produced and sold to cover all costs (Total Costs) incurred. I other word, it is the produced and sold quantity at which the company does not generate any profit, nor does it incur any loss. At the Break-Even Quantity (BEQ) the total revenue is equal to the total costs.Total Revenue (TR) is equal to the quantity (Q) sold multiplied by the price (P) of the unit sold:

| TR = P x Q | ||

| Or | TR = (P) (Q) | |

| Or | TR = PQ | ……………… (1) |

Total Costs (TC) are equal to the sum of Fixed Costs (FC) plus Variable Costs (VC). Fixed costs are production costs that do not vary with any quantity produced. Variable Costs are production costs that vary with the quantity produced (direct materials and direct labor costs):

| TC = FC + (VC x Q) | ||

| Or | TC = FC + ((VC)(Q)) | |

| Or | TC = FC + VCQ | ……………… (2) |

At the Break-Even Quantity (BEQ) – expressed as “Q” in this case, the Total Revenue (TR) is equal to the Total Costs (TC). Then, from equations (1) and (2):

| TR = TC | ||

| PQ = FC + VCQ |

Using simple algebra:

| PQ – VCQ | = FC | |

| Q (P – VC) | = FC | |

| Q | = FC / (P – VC) | ……………… (3) |

Break-Even Quantity (BEQ)

Looking at a numerical example, let us use the above formula:

Finding the BEQ for a production system with FC of $20,000 and the VC are $10/unit. The Price (P) is $15/unit.

So, if the BEQ quantity is Q = FC / (P – VC)

Substituting the values of the variables

Q = $20,000 / ($15 - $10)

Q = $20,000 / $5

Q = 4,000 units

Q = $20,000 / $5

Q = 4,000 units

Looking back at the original equations (1) and (2) and using 4,000 units of production(Q):

TR = P x Q = PQ

= $15 x 4,000

= $60,000

= $15 x 4,000

= $60,000

TC = FC + (VC x Q) = FC + VCQ

= $20,000 + ($10 x 4,000)

= $20,000 + $40,000

= $60,000

= $20,000 + ($10 x 4,000)

= $20,000 + $40,000

= $60,000

So, at the production (Q) of 4,000 units Total Revenues are equal to Total Costs. And that is the Break-Even Quantity.

It is worth noting that the Price minus the Variable Cost/unit (P – VC) is called “the contribution margin”. The contribution margin represents the amount available after the sale of each unit and the paying of the variable costs in that unit that contributes to the paying of the fixed costs.

References:

(1) Patrick J. Montana and Bruce H. Charnov, “Management”, Business Review Books, Third Edition, Baron’s (2000), p 392.

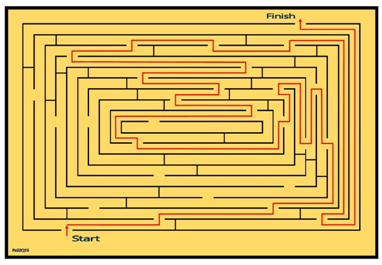

Solution of the Maze found on the previous page: